Contents

MISSION

To offer our clients the highest-quality products and services, at fair prices, in an appropriate environment, ensuring the highest satisfaction through attentive personalized service. The client is the reason for our work.

VISION

Consolidate and maintain leadership of our Group in the market, integrating the objectives of clients, personnel, suppliers and shareholders.

VALUES

Work: It is only through work that we can meet our needs, grow as persons and serve others, which is why we should seek our work to be a means of personal and professional development as well as emotional satisfaction.

Growth: To grow is to increase and improve our personal knowledge and abilities, so that together with the Group we can increase our capacity to offer more and better products through excellent service to our clients.

Social Responsibility: This responsibility represents doing our work well, reaffirming our values, fulfilling commitments with our clients and suppliers, respecting existing legislation and protecting natural resources and the environment.

Efficiency: Efficiency means being austere, caring for and efficiently utilizing the resources we have. Spend what is necessary and avoid what is useless and excessive.

![]()

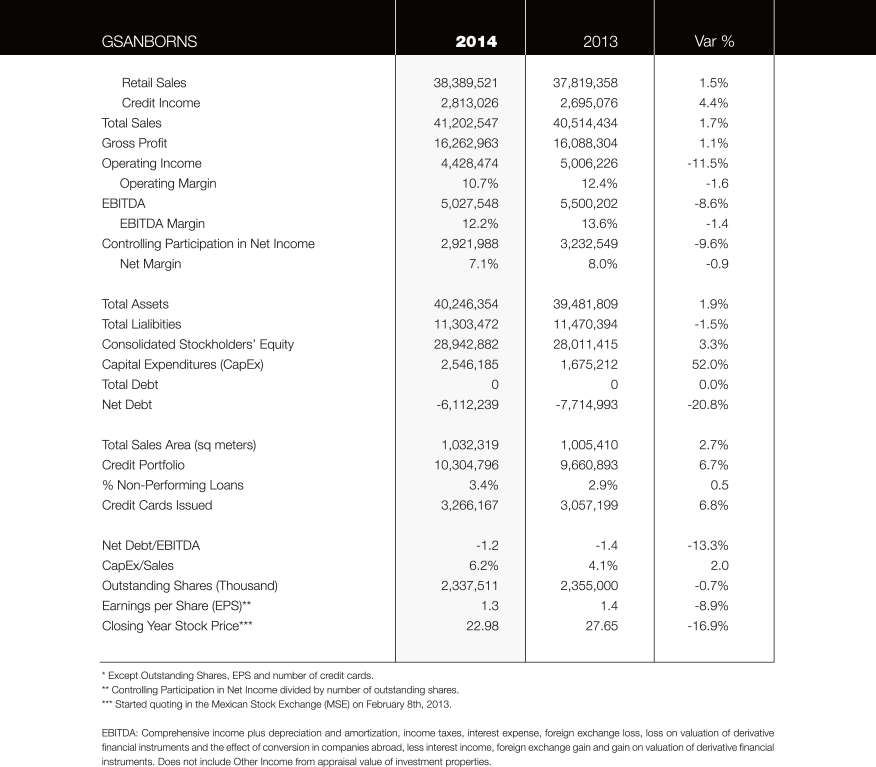

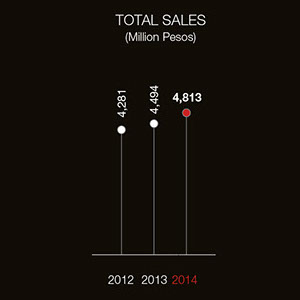

During 2014, Grupo Sanborns’ sales amounted to Ps.41,203 million, an increase of Ps.688 million or 1.7% if compared with the figure recorded in the previous year.

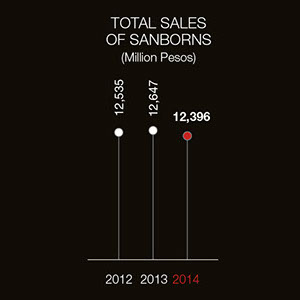

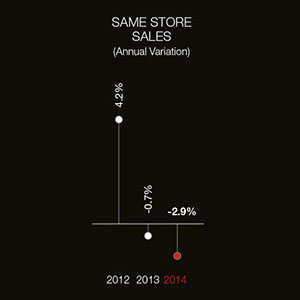

In terms of performance by format, iShop sales expanded 2.6%, meanwhile sales at MixUp stores increased 7.1% in the year. Moreover, sales at Dax, Saks Fifth Avenue and Sanborns Café stores, jointly with other shopping centers operated by the Company, increased 3.1%, however Sanborns’ sales fell 2%.

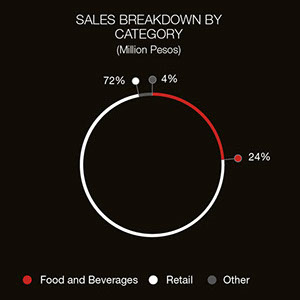

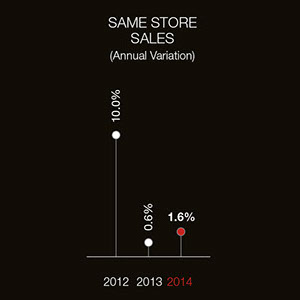

The above-mentioned increase in consolidated sales was mainly the result of the performance reached by Sears with a 52.5% contribution to total sales. In addition, Promotora Musical, which manages the iShop and MixUp brands and favorably provided an 11.7% contribution to total sales, benefited from the launching of new products and models.

As for the credit card operation, our proprietary cards continued to generate an ever-greater loyalty among our consumers. As a result, the number of proprietary cards issued increased 6.8% from 3.06 million cards in 2013, to 3.27 million cards by the end of December, 2014.

The credit portfolio grew 6.7% to reach Ps.10,305 million. Credit revenues amounted to Ps.2,813 million in comparison with the Ps.2,695 million figure recorded in the previous year, representing a 4.4% expansion in the period. Overdue 90-day loans were at 3.4% at the close of the year.

Operating income decreased 11.5% to reach Ps.4,428 million, in comparison with the figure observed in the previous year. This effect was mainly the result of the mix of sales, along with higher operating expenses derived from the Company’s expansion plan, remodeling works at stores, higher depreciation and increased expenses, as well as reserves for doubtful accounts. Moreover, EBITDA increased from Ps.5,500 million to Ps.5,028 million.

Net controlling interest income at Grupo Sanborns was Ps.2,922 million, a 9.6% reduction if compared against the Ps.3,233 million figure recorded in 2013.

As a consequence of a more ambitious expansion plan, capital expenditures grew 52.0% against the previous year, to reach Ps.2,546 million. Our plan included the opening of twenty new stores for the three major retail formats we operate. In that regard, the remodeling works at seven Sears and four Sanborns stores were expedited and concluded in 2014, earlier than expected.

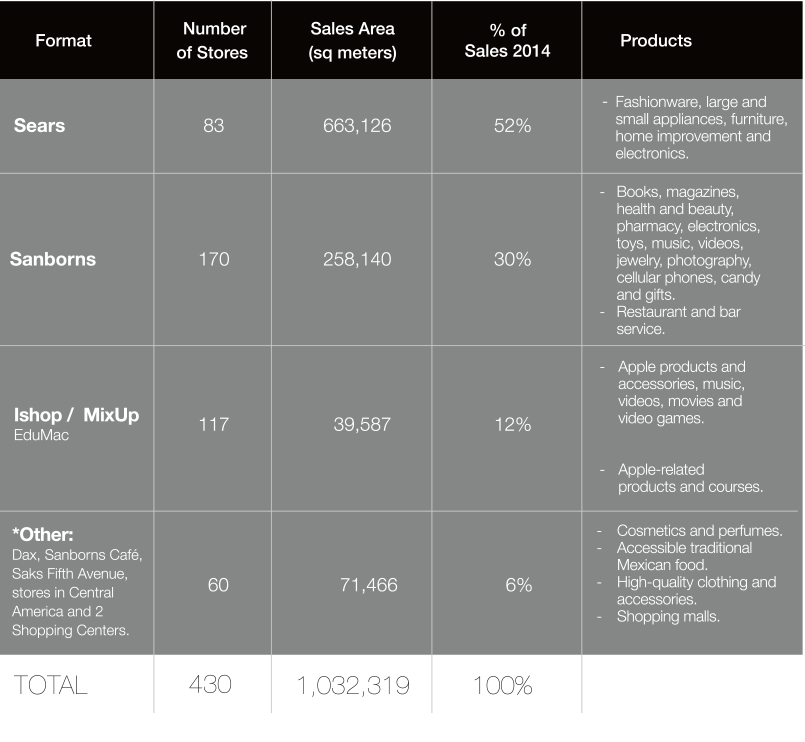

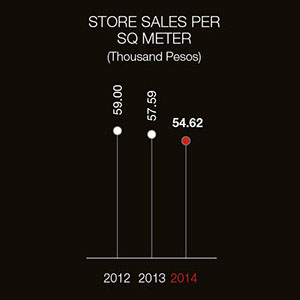

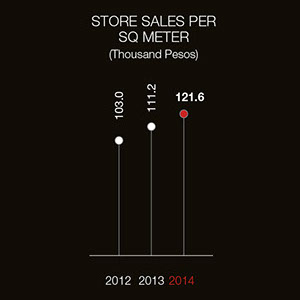

At the end of the year, Grupo Sanborns was operating 430 stores in all the retail formats, representing a retail area of 1,032,319 sqm., an increase of 2.7% against the previous year.

As of December 31st, 2014, the Company reported no debt, while cash and cash equivalents amounted to Ps.6,112 million, compared to the Ps.7,715 million figure recorded at the end of the previous year. The decrease of Ps.1,603 million in the cash position was mainly the result of the financing activities carried out and the execution of the Company’s expansion plan, as well as the increases observed in clients, the payment of dividends and repurchase of the Company’s own shares. Finally, net debt to LTM EBITDA produced a negative ratio of 1.2 times.

Atentamente,

Lic. Patrick Slim Domit

Director General de Grupo Sanborns S.A.B. de C.V.

Economic Outlook

The world economy in 2014 continued showing moderate growth. Global markets featured high volatility due to various economic and political factors, such as falling prices of raw materials and oil, the revaluation of the dollar, as well as international geopolitical tensions.

In 2014, various regional dynamics affected growth rates. As the United States showed signs of recovery, the Euro zone recorded signs of low performance; Japan reduced its expansion; and China continued to moderate its growth rate. Meanwhile, the slow evolution of developed economies impacted the emerging economies and, to a certain extent, the prices of raw materials. Moreover, falling oil prices benefited the advanced and energy-importing economies, negatively affecting the major exporting countries and contributing to the current weak demand through lower interest rates.

This global macroeconomic environment, coupled with expectations on monetary positions of world economies, mainly the United States, will produce adjustments to the investment portfolios, leading to the strengthening of the dollar against most currencies. As a consequence, this situation expanded the international financial volatility.

Economic activity in Mexico in 2014 showed moderate recovery against 2013, mainly due to an increase in external demand and, to a lesser extent, domestic demand. This scenario resulted in an annual growth of 2.1% in GDP, a rate that is still considered low.

At the close of 2014, prices of Brent and Mexican crude oil decreased 48% and 51%, respectively, in comparison with the closing prices of 2013. This adjustment will mainly affect public investment beginning in 2016, thus encouraging more private investment to take place. For 2015, the federal government has announced the introduction of preventive fiscal adjustments, with a zero-based budget to be implemented in 2016, which will allow a better qualitative improvement.

By taking advantage of the U.S. growth, low interest rates and favorable exchange rates, the Mexican market may further strengthen its exports and investments to accelerate economic activity, thus creating more and better jobs and promoting a dynamic domestic consumption. Also, the abundant availability of low-cost, long-term financial resources might be used to encourage private investment participation in the generation of productive development projects.

Grupo Sanborns

Our formats maintained at the consumers´ top of mind through the pursuit of the commercial and operational strategy. We stood firm in the approach to customer service, in providing a wider range of fashion options and a greater number of brands at attractive prices.

We capitalized the advantages of reduced import tariffs of goods from China, as well as zero-tariff goods from certain countries in Asia, North America and Europe. At Sears fashion items have been increasing their penetration into the sales mix.

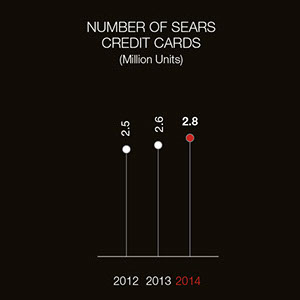

The credit business, in various forms, remained as one of our main pillars of organic growth. During 2014 credit sales with our card went from 55% to 58% of sales. In the newly opened stores of Sears Mazatlán, Los Mochis and Celaya Galerías, the Sears card has quickly established itself as the preferred payment method for our customers. Throughout the fiscal period, we issued 209,000 new cards whereby cardholders reached 3.27 million, which represents a growth of 7%. We continued with the efforts of reactivation of cardholders and promotions to differentiate us in the market.

Sanborns restaurants continued the relentless commitment to excellence in the relation value, service and food price. In the store, we draw some difficulties in the supply of certain categories through the development of alternative suppliers and careful selection of inventory. Regarding loyalty programs we are very pleased to say that we have over one million members at the Sanborns Circle of Reading and we have just launched the Circle of Wellness, a new project to access attractive promotions and benefits in the health area. Since the joint procurement implemented in August 2014 we have improved the range of fragrances, accessories, cosmetics, jewelry and novelties. In some of the 5 new Sanborns stores located near offices such as: Bamer, World Trade Center and Toreo, we launched the coffee bar concept by inserting it into our successful concept.

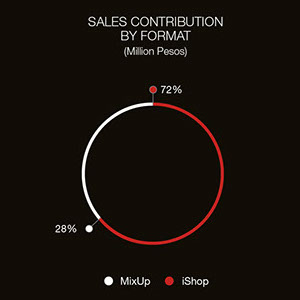

At the end of the year iShop launched the new iPhone 6 and opened 12 new stores, and contributed with 72% of the sales of Promotora Musical; while MixUp closed six stores. During 2015 we estimate that the recent openings of iShop with new image will reach their potential of sales. Three new iShop stores were conversions from MixUp to iShop.

It is important to note that from 2013 as of today, we have 19% of the Sears stores with a better image, including new stores and remodeling. These have shown an average sales growth of 19% after the remodeling, as of March 2015.

Grupo Sanborns revenues amounted to Ps.41,203 million. Operating margin was 11% and the EBITDA margin was 12%. Net income was Ps.2,922 million and net income per share was Ps.1.3.

The financial position of Grupo Sanborns remains sound, total assets were Ps.40,246 million, with liabilities of Ps.11,303 million. Stockholders’ equity ended the year at Ps.28,943 million.

Grupo Sanborns has no debt at December 31, 2014, while the amount of cash and short-term investments totaled Ps.6,112 million. The decrease of Ps.1,603 million in cash during the year was due to investments in store openings and to pay an ordinary dividend of 0.80 pesos per share in June and December.

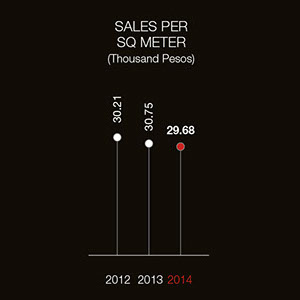

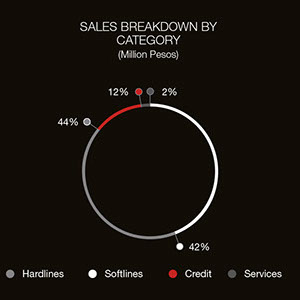

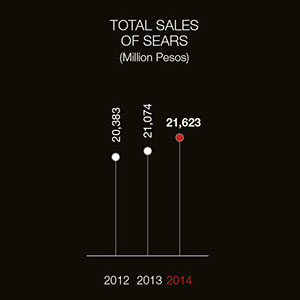

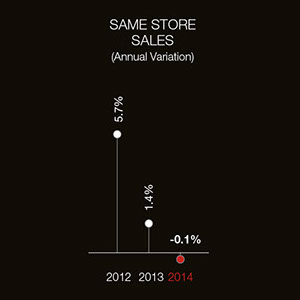

During 2014, Sears’ sales amounted to Ps.21,623 million, which represented a 53% contribution to total sales and a participation of 58% in Grupo Sanborns’ consolidated EBITDA. Among the most important activities of the year was the opening of the Los Mochis, Galerías Mazatlán and Celaya Galerías’ stores. Additionally, the complete remodeling of four stores was carried out, and the Company is continuing the various phases in the remodeling of six stores, initiated during 2014, and which are expected to be delivered by mid-2015.

The renovation of Sears stores is being continued, so they will eventually present a more modern image to their customers, with a greater focus on fashion and footwear, as well as on the latest in home appliances and other articles. Sears is the second largest department store chain in the country, with 2,769,000 proprietary credit cards issued as of the close of 2014, to thereby maintain its position as the second largest non-bank player in Mexico.

The amount of resources channeled to investments in fixed assets increased 52% to Ps.2,546 million corresponding to the opening of 20 new stores of the three major retail formats and the renovation of 17 stores. Eleven stores were completed while the rest continues in renovation in 2015.

We will further strengthen the performance of existing stores and work in purchasing and distribution synergies that will allow us to provide the right choices at the right time and place to our customers, strengthen our market position and generate profitable and sustainable growth.

About sustainability issues and social welfare, we are taking advantage of the Carlos Slim Foundation, an organization that aims to foster the integral development of human resources through programs that strengthen the skills and abilities of people of all ages in Mexico and Latin America. In the pursuit of that goal, we strive to help people succeed in their own economic and social development and opportunities and to achieve a better quality of life.

Towards this purpose, the Carlos Slim Foundation participates jointly with private initiative, the three levels of government - federal, state and municipal – and society to meet educational, health, justice, human development, sports, environmental, cultural, humanitarian aid, and economic development goals. By accomplishing the foregoing, we benefit the largest possible number of people, as well as the most vulnerable groups.

Regarding environmental protection during 2014 we kept the replacements of fluorescent lamps and the installation of solar panels, refrigeration and air conditioning controls as well as programs to reduce paper use and recycling.

Furthermore we increased the training events to 39 thousand benefiting more than 85 thousand employees of Grupo Sanborns. We continue to work in the food donation program to various NGO’s and hiring people with disabilities.

For all these reasons, we are motivated to keep improving the results achieved in 2014. I thank again our customers and suppliers for their support, as well as all employees that form part of our Group, for whom I also appreciate their effort, commitment and dedication.

Sincerely,

Carlos Slim Domit

Chairman of the Board of Directors of Grupo Sanborns, S.A.B. de C.V.

During 2014, Sanborns recorded sales of Ps.12,396 million in the year, which represented a 30% contribution to total sales and a 16% participation in the Company’s consolidated EBITDA. In that same period, five stores were inaugurated – Bamer, Veracruz El Dorado, World Trade Center and Monterrey Nuevo Sur – including the Toreo store, a unit that was relocated. Considering the above, the Company operated 170 stores, representing 258,140 sqm. of commercial area at the close of the year.

Sanborns is recognized by its unique retail concept in Mexico. The chain is the leading seller of some of the most representative products and services categories, including books, photography equipment, mobile devices, and perfumes and cosmetics. Additionally, it is the second largest bar and restaurant operator in the country.

MixUp is Mexico’s largest music and video retailer. iShop, on the other hand, is the largest store chain in Mexico that sells Apple brand products and accessories, and the only authorized service center that provides training for EduMac.

\

![]()

\

During 2014 12 new iShop stores were inaugurated: Antea Juriquilla, Lindavista, Génova, Madero, Colima Zentralia, Perinorte, Nuevo Veracruz, Quinta Alegría in Playa del Carmen, Campeche, Toluca, Serdán Puebla and Toreo. The retail area of Promotora Musical totaled 39,587 square meters at the end of 2014.

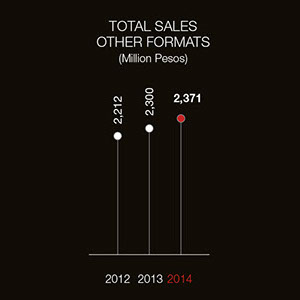

Complementing the diversified portfolio of the Group, we have other formats such as: • Sanborns Café, which has a presence in 6 states in Mexico and Mexico City, • Dax regional retail chain for cosmetics and perfumes, • Saks Fifth Avenue, 2 luxury department stores that carry international designer fashionware, • Two shopping malls, Plaza Loreto and Plaza Inbursa and, • 1 Sears store and 3 Sanborns stores in Central America and 3 boutiques.

![]()

![]()

During 2014 one Dax store and three Sanborns Café were closed. One Sanborns Café was opened in Parque Vía, therefore the retail area of Other Formats totaled 71,466 square meters.

Social Responsibility

We consider social responsibility to be a commitment to the satisfaction of our customers and shareholders, along with an interest in our employees and the community in general. We observe an adherence to strict ethical standards, a long-term vision, and compliance with the laws wherever we operate, while seeking to make economic development and environmental protection a fundamental part of our competitiveness.

Mission of Social Responsibility

To promote entrepreneurial creativity applied to business and to the solution of our country’s problems from our fields of action, based on human development, staff training, optimism, teamwork and tireless improvement of our processes, under a philosophy of austerity in spending, reinvestment of profits, modernization and growth, generating benefits for our customers, employees and all other participants.

Social Performance

We work through the Carlos Slim Foundation, which aims to foster the integral development of human capital through programs that strengthen the skills and abilities of people of all ages in Mexico and Latin America, so that they can become actively involved in the development of economic and social affairs, benefit from more and better opportunities and obtain a better quality of life.

The Social Welfare Program implemented in Grupo Sanborns benefited 3,867 employees and their families, through the realization of 71 human development activities in the fields of health, education, culture and recreation. In addition, investments in education, health, and infrastructure and community development through the following initiatives were held:

- Rescue program of buildings

- Preventive programs for control of diseases

- Donations in kind

- Hiring people with disabilities

- Collaborative activities conducted together with Telmex and the Carlos Slim foundations

Environmental Performance

Grupo Sanborns maintains programs aimed at saving energy (gas and electricity) and water, and the use and recycling of paper. Results obtained annually from these programs are included within the Carso Environment Report for 2014, which includes:

- An update of Environmental Policy

- The implementation of projects that were pro posed in the year 2013

- The presentation of environmental indicators by sector and / or company

Work Performance, Health and Safety

As of December 31st, 2014, Grupo Sanborns employed more than 45 thousand full-time and part-time workers. Grupo Sanborns has ongoing training programs that are in line with the Company’s strategic and organizational plans. Some of the areas of training include customer service and care, leadership, teamwork, and operations management. Programs oriented towards product familiarity are developed with the support of suppliers and considering a win-win approach.

Sears has two training centers in the Mexico City area, as well as one located in the city of Tijuana, Baja California, and 78 units within the stores. Continuous training is offered by means of certification of leadership, business simulator, management courses and coaching programs. During 2014, an average of 19.14 courses were taken by every Sears employee, with an emphasis on sales techniques and client care and services.

During the year, the “Vivamos nuestra Cultura” program was developed jointly with the operating area of the Company. The program was designed to be a vehicle for communicating at every store our mission, vision and values. In addition, the Carlos Slim Foundation’s “Capacítate para el Empleo” platform was adopted as a vehicle for attracting the best talent available.

Additionally, all of the Company’s operating subsidiaries carry out training programs that have also had a positive effect on key personnel and other employees, such as the following:

- Educational and scholarship programs for em- ployees and their immediate families

- Granting of digital scholarships

- Annual sporting events

- Programs for self-development through the Association for the Growth of Mexico (ASUME)

During 2014, more than 39,000 training events for more than 85,000 participants from Grupo Sanborns were carried out. Also, preventive health programs are maintained, in collaboration with the Social Security Institute (IMSS) and the Ministry of Health (SSA).

For further information and details, see the section on sustainability activities in the Grupo Sanborns S.A.B. de C.V. website, at www.gsanborns.com.mx.

José Kuri Harfush

Chairman

Juan Antonio Pérez Simón

Antonio Cosío Pando

Annual Report

To the Board of Directors:

I, the undersigned, in my capacity as Chairman of the Audit and Corporate Practices Committee of Grupo Sanborns, S.A.B. de C.V. (the “Committee”), hereby submit the following annual activity report for the fiscal year 2014.

Functions of Corporate Practices, Evaluation and Compensation

The Chief Executive Officer of Grupo Sanborns, S.A.B. de CV (the “Company”) and the relevant executives of the entities the Company controls complied satisfactorily with their objectives and responsibilities.

On April 28th, 2014 Grupo Sanborns, S.A.B. de C.V. decreed dividends in the amount of Ps.1,884 million, of which 50% were paid on June 20th, 2014 and the remainder on December 19th, 2014.

The Sanborns subsidiaries, Sanborn Hermanos, S.A. and Sears Operadora Mexico, S.A. de C.V., also decreed dividends in the amount of Ps.300 million and Ps.500 million, respectively.

A capital increase in the variable portion of the subsidiary Grupo Inmobiliario Sanborns, S.A. de C.V., was authorized to take place on September 1st and October 1st, 2014 for Ps.300 million on each of the said dates. The capital increase was duly authorized to be underwritten and paid by entities that act as shareholders in proportion to their right of first refusal, to thereby bring the Company’s equity to Ps.1,200 million at the close of the year. The increase will be paid as the resources are required for the execution of the Company’s expansion programs.

After consideration by the Committee, related party purchase-sale transactions were authorized in the amount of Ps.510.8 million for sales and other income and Ps.3,786.7 million for general expenses.

The principal transactions were with Radiomóvil Dipsa, S.A. de C.V. and América Móvil S.A.B. de C.V. involving the purchase of handsets, rate plans, telephone memory cards, and other items from the Company and its subsidiaries; Teléfonos de Mexico, S.A.B. de CV, for call center services, telephone installation and the sale of telephony items; dining room services. Seguros Inbursa, S.A., for insurance on the Company’s vehicles and insurance on its own and on its subsidiaries real estate; commissions; dining room services; to the subsidiaries of Inmuebles Borgru, S.A. de C.V. and Inmuebles SROM, S.A. de C.V. for the lease of real estate; Banco Inbursa, S.A. for leases, commissions, food sales and dining room services provided to other companies.

All transactions with related parties were reviewed by Galaz, Yamazaki, Ruiz Urquiza, S.C., and a sum thereof has been recorded in a note of the audited financial statements of Grupo Sanborns, S.A.B. de C.V. and subsidiaries as of December 31st, 2014.

The Chief Executive Officer of Grupo Sanborns, S.A.B. de C.V. does not receive any remuneration for the performance of its activities. The Company has no employees, and in regard to the total compensation received by the executive officers of the companies controlled by the Company, we make sure that the policies adopted in this regard by the Board of Directors have been complied with.

The Board of Directors of the Company did not grant any waiver to any councilor, pertinent director, officer or person with powers of command to take advantage of business opportunities for themselves or for third parties, in regard to business opportunities corresponding to the Company or entities it controls or in which it has significant influence. Nor did the Committee grant any waiver for the transactions indicated under subsection c) of section III of Article 28 of the Securities Market Act.

Audit functions

The internal control and internal audit system of Grupo Sanborns, S.A.B. de C.V. and of the entities it controls is satisfactory and meets the guidelines approved by the Board of Directors, according to the information provided to the Committee by the Management of the Company and the independent auditor’s report.

We had no knowledge of any noncompliance with any guidelines or policies concerning the operation or accounting rules of the Company or in regard to the entities it controls, and consequently, no preventive or corrective action was implemented.

The performance of the accounting firm Galaz, Yamazaki, Ruiz Urquiza, S.C. the entity that conducted the audit of the financial statements of Grupo Sanborns, S.A.B. de C.V. and subsidiaries as of December 31st, 2014, and the performance of the independent auditor in charge of the said audit was satisfactory and the objectives set at the time of contracting the said entities were achieved. Also, according to the information provided by the said firms to the Management of the Company, their fees for the independent audit represented a percentage of less than 10% of their total revenue.

As a result of the review of the financial statements of Grupo Sanborns, S.A.B. de C.V. and its subsidiaries as of December 31st, 2014 it was determined that there are no material errors caused by fraud, and the major adjustments proposed originated from excess funds in reserves for unrecoverable accounts, excess funds in provisions, and insufficient funds in deferred taxes.

In accordance with information we received from the Company’s Board of Directors and during the meetings in which we participated, which were attended by independent and internal auditors and carried out without the presence of officers of the Company, as far as we know there were no relevant comments from shareholders, councilors, directors, relevant officers and employees and, in general, from any third party, regarding accounting, internal controls or other issues related to internal or external audits, or complaints made by those persons on irregularities in the administration of the Company.

During the reporting period, we verified that resolutions adopted by the Shareholders’ Meeting and the Board of Directors of the Company were complied with. Also, according to the information provided to us by the Company’s Board of Directors, we verified the existence of controls designed to determine compliance with the provisions applicable in terms of financial markets and that the legal department reviewed such compliance at least once a year. There were no comments in regard to any adverse change in the Company’s legal status.

Regarding the financial information that the Company prepares and submits to the Mexican Stock Exchange and the National Securities and Exchange Commission, we have verified that this information was prepared under the same principles, criteria and practices with which the annual information was prepared.

Finance and Planning functions

During fiscal year 2014, the Company and some of the entities it controls made significant investments. In this regard, we made sure that any financing that was undertaken was made in a manner consistent with the strategic medium- and long-term plan of the Company. In addition, we ensured that the strategic position of the Company was in alignment with the plan. We also reviewed and evaluated the budget for the fiscal year 2014 together with the financial projections that were considered for its construction, including major investments and financing transactions of the Company, which we considered feasible and consistent with investment and financing policies and the Company’s strategic vision.

The contingencies of a worker, civil, commercial and administrative nature as of December 31st, 2014, showed a behavioral trend similar to previous years, so that the resolution of these claims will not affect the financial position and economic stability of the companies involved.

During 2014, the Company carried out the repurchase of Company shares in the amount of Ps.394 million.

Income from the revaluation of investment property (Malls) in the amount of Ps.220.9 million was recorded in 2014.

The provisions entered in the books as accrued expenses must meet the criteria of a liability under IFRS, so that only provisions on commitments or expenses that have already been accrued can be recorded.

In regard to matters related to fraud, breach of laws, regulations and undue influence by management over the manner in which the audit was conducted, the pertinent investigations were made with management, and various procedures were applied, without discovering any irregularity.

In preparing this report, the Corporate Practices and Audit Committee relied on information that was provided by the Chief Executive Officer of the Company, the relevant officers of the entities it controls, and by the independent auditor.

Chairman

José Kuri Harfush

Depositary Bank:

BNY Mellon

Shareowner Services

P.O. Box 358516

Pittsburgh, PA 15252-8516

Tel. 1-888-BNY-ADRS(269-2377)

1-201-680-6825

Mexican Stock Exchange

The series B of Grupo Sanborns S.A.B. de C.V. is listed in the Mexican Stock Exchange under the ticker symbol “GSANBOR”.

CONTACT

Angélica Piña Garnica

Internet Address

To obtain more information about Grupo Sanborns and its sustainability activities please visit our corporate webpage at:

http://www.gsanborns.com.mx/english/index.html

Corporate Headquarters

Plaza Carso

Lago Zurich No.245

Presa Falcón Building, 7th Floor

Ampliación Granada

México, D.F. 11529

American Depositary Receipts (ADR’s)

Starting on January 27, 2014 Grupo Sanborns S.A.B. de C.V. established an ADR program level 1 with Bank of New York Mellon, through which American investors can trade securities in the Over the Counter Market (OTC) under the ticker symbol GSAOY at a rate of 5 ordinary shares to 1 ADR.

Cusip Number: 40053M103

Design and Programming: FechStudio.com

This report contains forward-looking statements. By their nature, projections and general statements are specific, and risks may cause predictions, forecasts, projections and other forward-looking statements to differ materially from current expectations. Although we believe the plans, intentions and expectations reflected in or suggested by these forward-looking statements are reasonable, the Company cannot ensure that these plans, intentions or expectations will be achieved. Additionally, the reader must not interpret statements regarding past trends or activities as assurance that such trends or activities will continue in the future.