MENU

CONTENTS

2021 ANNUAL REPORT

2021

started with a gradual recovery, thanks to the progess of the vaccination plan.

After the year of 2020, severely affected by the COVD-19 pandemic, in which the world GDP experienced a drop of 3.1%, 2021 began with a gradual recovery, thanks to the progress of a vaccination plan and a greater knowledge of the treatment of the disease, in addition to an unprecedented stimulus program. According to the FMI, the world´s GDP grew by 5.9% in 2021.

The United States economy grew by 5.7% in 2021, after an adjustment of 3.5% the previous year, driven primarily by personal consumption and fixed gross investment, which increased by 7.9% and 7.8%, respectively, compensating for a greater commercial deficit and a lower governmental expenditure.

In Mexico, the GDP grew by 5.0%, after having dropped 8.4% in 2020, driven by secondary activities, which rose 6.8%, and highlighting a 9.0% recovery in the manufacturing industry and a rise of 7.3% in construction. Tertiary activities grew by 4.2%, with a strong recovery of 10.7% in commercial activity, compensating for a 3.4% drop in financial services.

In Mexico, the GDP grew by 5.0%, after having dropped 8.4% in 2020, driven by secondary activities, which rose 6.8%, and highlighting a 9.0% recovery in the manufacturing industry and a rise of 7.3% in construction.

In Mexico, the GDP grew by 5.0%, after having dropped 8.4% in 2020, driven by secondary activities, which rose 6.8%, and highlighting a 9.0% recovery in the manufacturing industry and a rise of 7.3% in construction.

The Mexican peso closed at $20.58 against the dollar for a depreciation of 3.2% and fluctuating between $19.60 and $21.92 during the year. The difference in interest rates between Mexico and the United States became increasingly greater throughout the year. The Bank of Mexico raised the reference rate six times, bringing it from 4.25% in 2020 to 6.00% at the end of 2021, while the United States interest rate remained unchanged.

Inflation, driven by the commercial disputes with China, has pressured the Central Banks into raising the interest rate. In Mexico, inflation closed at 7.4% due to the increase in the prices of raw materials and oil on a worldwide level. The core component increased by 5.9% while the non-underlying component increased by 11.7%. In the United States, on the other hand, inflation increased to 7.04%.

In 2021 the commercial balance had a deficit of $11,491 MDD [million dollars], compared to a surplus of $34,013 MDD the previous year. The petroleum balance reached a deficit of $24,926 MDD, which is greater than in 2020 by $11,002 MDD, and the non-petroleum balance decreased its surplus by $34,503 MDD to end at $13,435. In exports, manufacturing rose by 16.7% and imports increased in every sector, with an increase of 34.9% in consumption goods. The worldwide shortage of semiconductor chips was the reason Mexico exported only 2.7 million vehicles in 2021, 0.94% greater than in 2020, but still 20.1% less than in 2019. The price of Mexican oil products rose from $35.8 USD per equivalent barrel to $64.60 USD/barrel in 2021.

Public finances continued healthy, thanks to greater revenues from the economic recovery and the containment of expenditures by the government’s austerity policies. The public balance had a deficit of -757,790 million pesos, like the equivalent of 2.9% of the GDP in 2020. The national debt as a percentage of the GDP diminished from 51.7% in 2020 to 50.1% in 2021.

The challenges have continued in 2022 with its first months complicated by the Russian invasion of Ukraine, which has caused an increase in the price of energy, food, and raw materials on a worldwide level, causing additional inflationary pressures and uncertainty regarding world growth during the year.

In Grupo Sanborns, although the year began with restrictions on the percentages of customers in restaurants and department stores, social mobility and the influx of customers gradually increased until sales increased 35%, reaching a total of $52,939 million pesos.

Sears recorded an increase of 37.5% in total sales, Sanborns, 31.4.%, and MixUp/iShop an increase of 36.6%. Big ticket items and technology continued to be strong categories because of the tendency towards connectivity that presently exists, with a greater demand for tablets, cell phones and accessories for remote work, virtual education, virtual meetings, and entertainment. Sales in fashion, which had been growing in a constant manner in Sears, reduced during the COVID-19 pandemic, and therefore we focused our efforts on clothing and footwear throughout the year, to offer our customers both casual and formal wear, as a return to the work place and to public events is taking place.

In the Sanborns restaurants we also endeavored to have certain food products more available for our customers, and a recovery in food and beverages was observed, closing the year with figures similar to those of 2019.

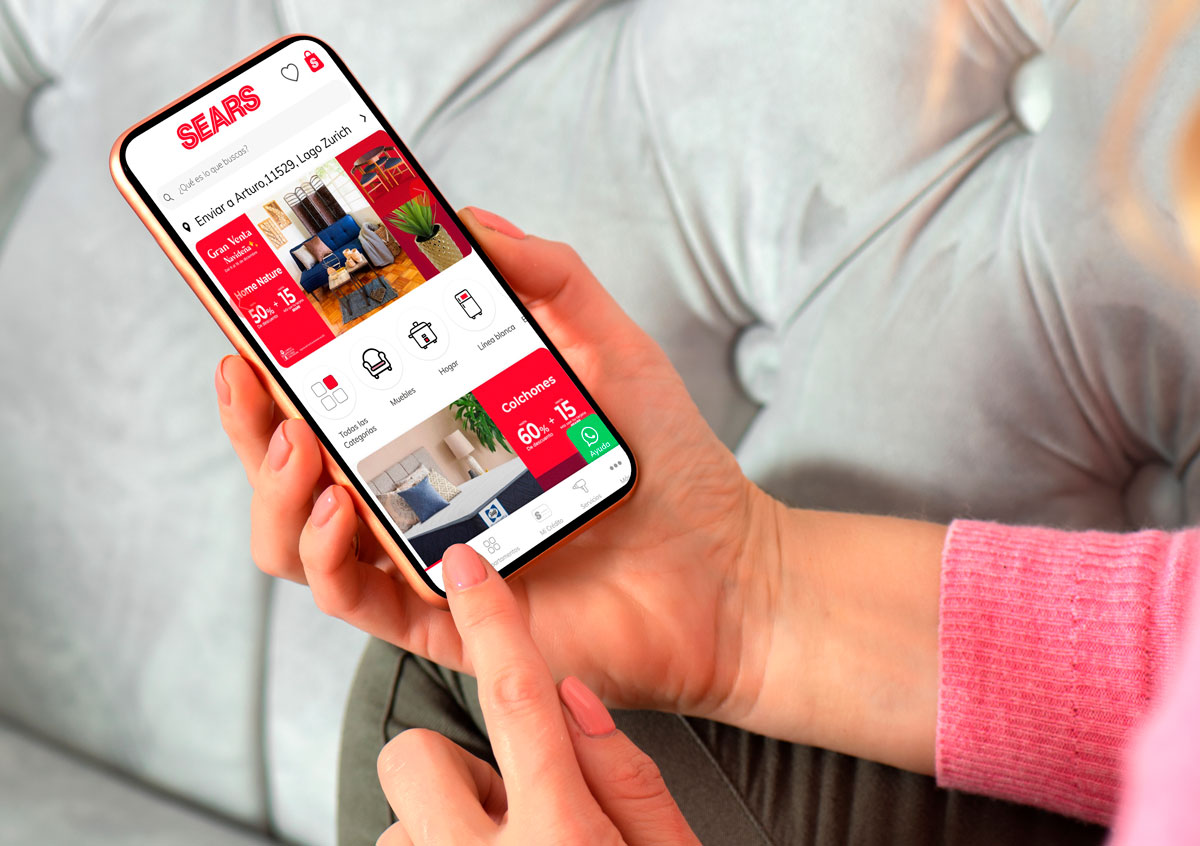

In 2021 we have continued to invest in the e-commerce platforms. Online sales grew 3.5 times compared to the previous year. Important improvements were realized in the Claroshop Marketplace, enabling a greater number of providers, and a greater delivery speed was achieved with an average of 2-3 days in Sanborns and 3-4 days in Sears. Progress was made in various projects, such as in the “click and collect” modality, which reduces the delivery time and the cost. Towards the end of the year we also launched the Sears and Sanborns Apps, in which, besides making purchases through mobile devices, the account balance can be accessed and payments can be made.

In coordination with the management of Sears and Sanborns, additional measures of optimization were introduced: the inventory was optimized, the stores were consolidated, and costs and expenses were reduced. Changes that were made in the medium-term strategy included an overhaul of operations in order to make the shopping experience of the customers more pleasant. The departments that were the most profitable were restructured in order to produce a greater profit per square meter. The restaurants continued to improve their packaging, especially regarding take-out orders.

As we move forward, we will continue to work on e-commerce initiatives as well as regarding our physical stores, which represent the principal means of face-to-face interchange with our customers.

As we move forward, we will continue to work on e-commerce initiatives as well as regarding our physical stores, which represent the principal means of face-to-face interchange with our customers.

3.5

times growth in online sales compared to the previous year.

As we move forward, we will continue to work on e-commerce initiatives as well as about our physical stores, which represent the principal means of face-to-face interchange with our customers and that will continue to be an important element in that regard. We expect to make working capital investments in logistics, a distribution center, and the delivery fleet, in order to deliver our customers’ orders from the closest store rapidly, at a lesser cost and with better service, always endeavoring to make the multi-channel experience of our customers as satisfactory as possible.

Sincerely,

Chairman of the Board of Directors of Grupo Sanborns, S.A.B. de C.V.