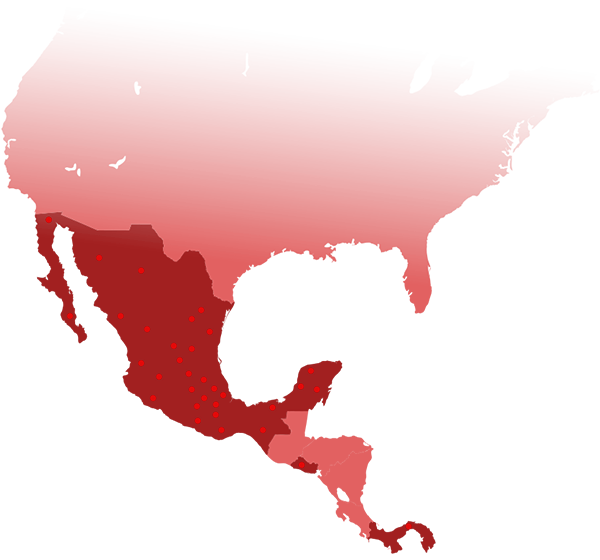

Grupo Sanborns has wide geographic coverage with a focus mainly on Mexico.

Through our network of stores we have a presence in 57 cities throughout the country.

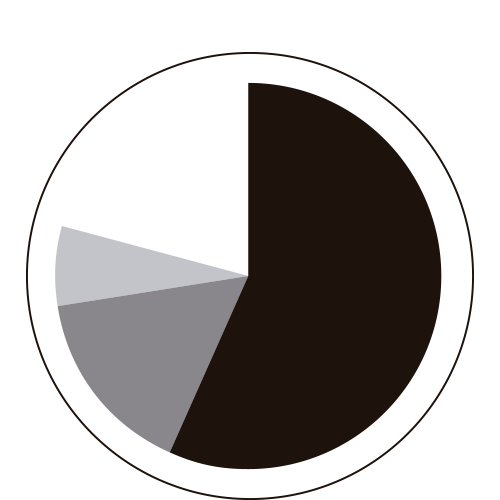

| Format | Number of stores | Sales area (Sqm) | % of sales 2016 | Products |

|---|---|---|---|---|

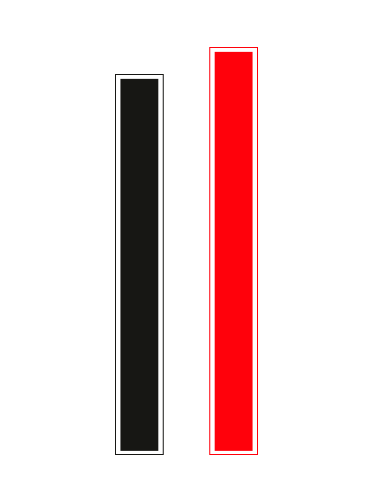

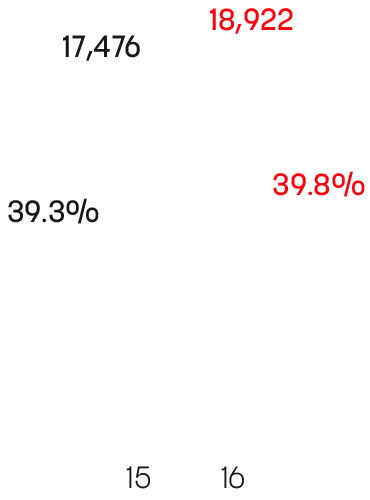

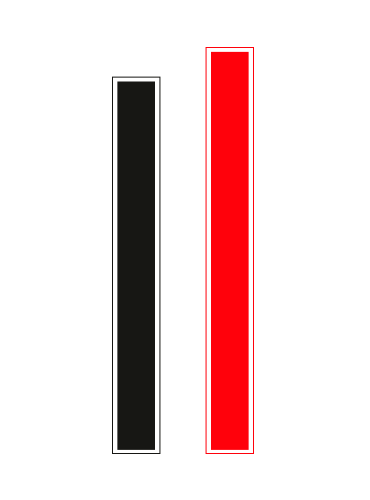

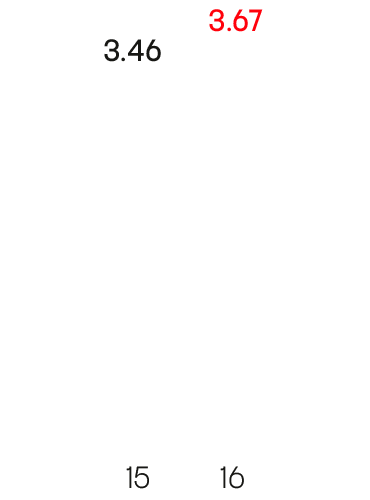

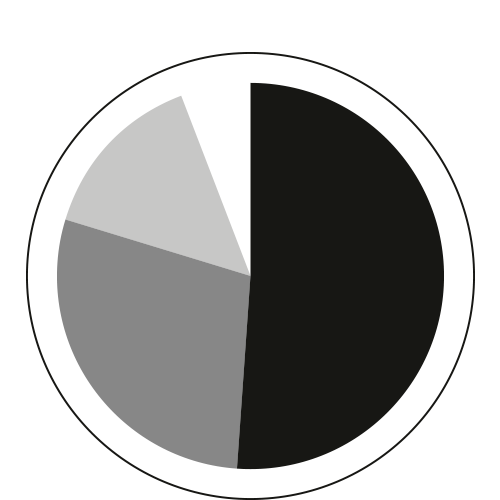

| Sears* | 98 | 809,248 | 52% |

|

| Sanborns | 176 | 268,446 | 27% |

|

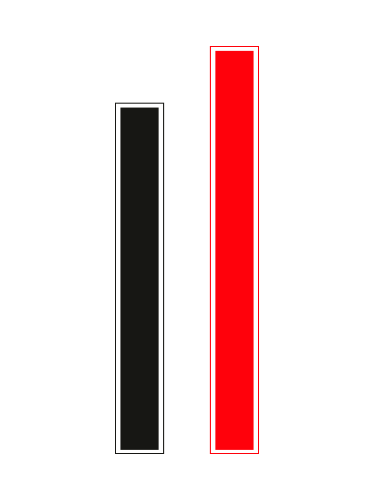

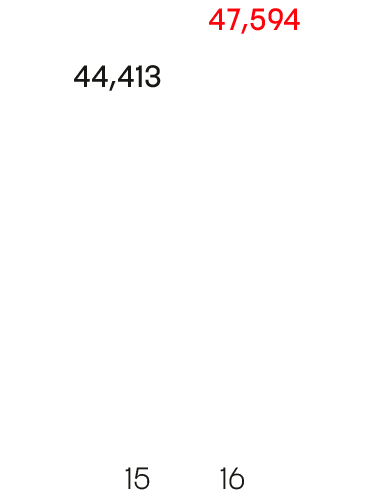

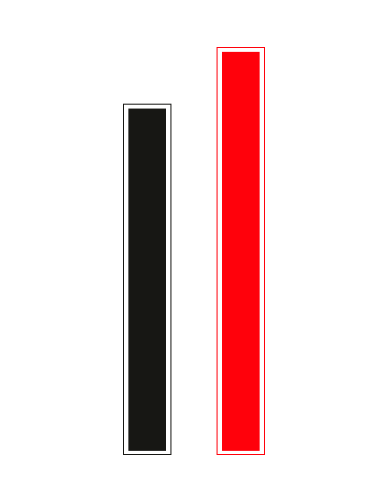

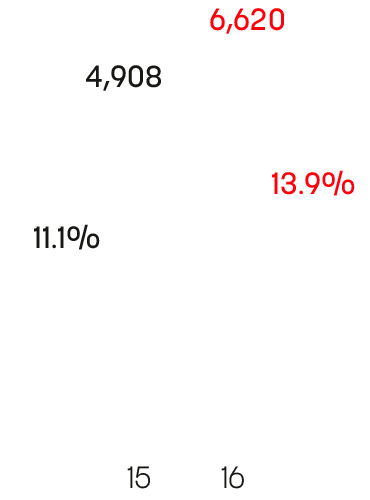

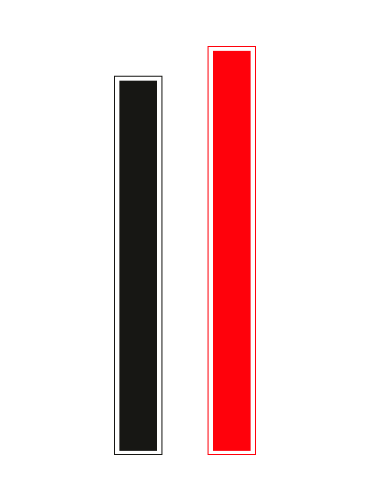

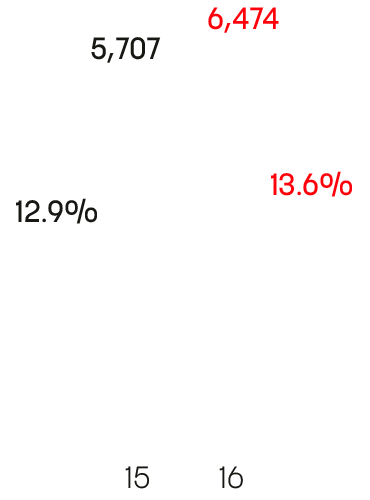

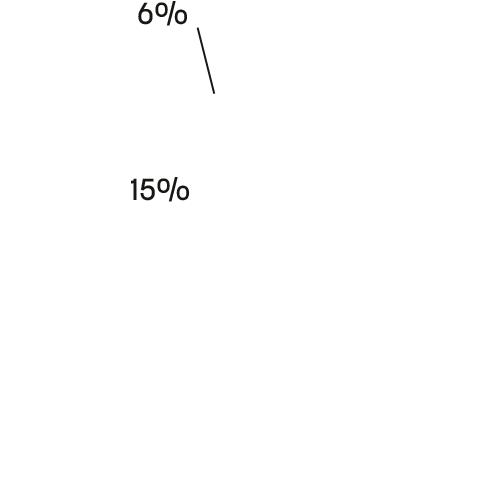

| iShop/Mixup | 112 | 37,821 | 15% |

|

|

*Other:

|

56 | 70,715 | 6% |

|

| Total | 442 | 1,186,230 | 100% | |

| * Includes 5 Boutiques | ||||